Picture from Fiscal Policy Office, Department of Local Administration Volume 5, Number 1: November 2020 | Oped

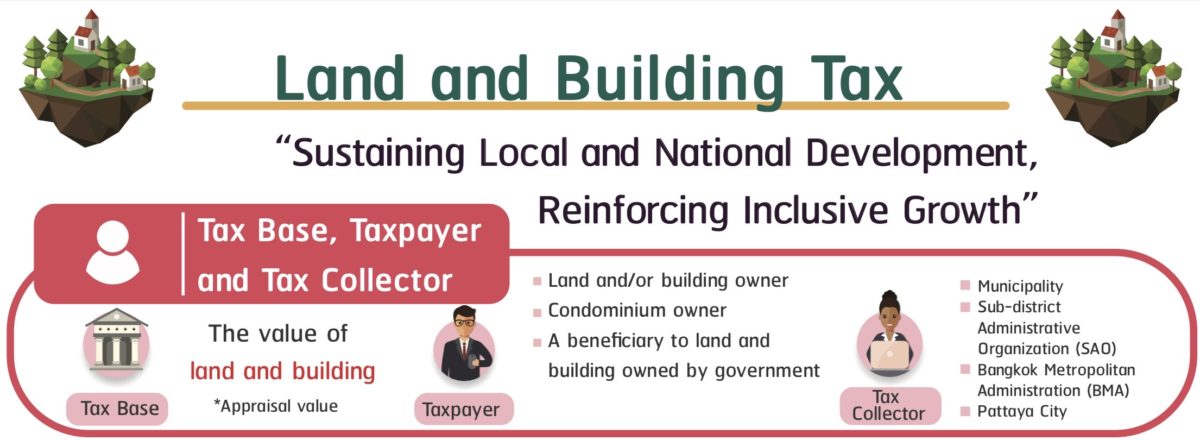

Property tax is a tax collected from the land and property owner on the value of their properties by the local government where the property is located. However, Thailand just recently has an Act, since January 2020, which could be fully called as a property tax.

Before this Thailand used an Act under the name of Building and Land Tax Act 1932 which had been enhanced since Thailand got democracy and civilian government. In this Act, the tax was collected from the property income which was the rental prices at rate 12.5%. So, the taxpayers under this Act were the entrepreneurs. However, collecting tax under this Act was implemented by the revenue department which is the central government. Later in 1965, Thailand also enforced Local Maintenance Tax Act which collected the tax from the land and property owners. Nevertheless, both were old, not consistent with the current context and the tax revenue had not been worth the operating cost. Therefore, They have been both cancelled and replaced by the Land and Building Tax Act 2020. The new Act can collect more tax revenue than the old. However, There are two sides of opinions : agree and disagree with the new Act in Thailand context. However, I agree with the new Act for three reasons such as capitalization of houses, developing wealth distribution and promoting democracy.

Nevertheless, the thing that the readers need to know before taking the side of whether you should agree or not is the differences in main detail of property tax Act between Thailand and the US. First, since Thailand is not a decentralized state, there is only one property tax rate across the country while the US rate varies across the state between 0-4%. Second, not every home or land owner has to pay this tax. For the first residential house, only over 50 million baht home with land will be taxed. The minimum of the residential value is lowered when it comes to the second residential house which starts at 10 million baht. For the US, no matter how much the value of the property, all have to be taxed(there could be some exemptions in some states). Third, the rate of property tax in Thailand is very small relative to the average of the US. The ceiling Thai tax rate for the resident is only 0.3%.

There are 3 reasons why I support the new Act of Thai property tax.

First, property tax is housing capitalization. The more tax could be collected, the more money could be used to develop the jurisdiction. The local government can use the tax revenue to develop infrastructure like school, libraries, playground, park and road for example. When the jurisdiction is developed, the price of a house will be higher. When the society is better, it attracts the newcomers not only the residents but also the business investment. All of us will be better off.

Secondly, from my point of view, this taxing system helps wealth distribution since only the upper middle class and above can own a first house worth over 50 million baht and the second house worth over 10 million baht. Some people called this tax “ the rich tax”, since the value of property can imply their wealth. The richer you are, the more you pay. Taxing the rich to develop the whole society which increases overall social welfare. However, some people, especially for the rich, said it’s not fair for them to be only taxpayers. In my opinion, the rich may miss a point that if the whole society gets better, they also benefited, not only from the housing capitalization but also the better environment and safety of the society. Wondering if all children can access the education at the nearby school which receives funding from the property tax, there will be no children becoming a criminal. Nobody wants to be a criminal but the social structure forced them to be.

Lastly, the property tax which is collected by the municipal rather than the central government creates the stronger of democracy by the higher participation of people in each jurisdiction. There is an improvement in efficiency of the political system. In the past, since the municipality could collect small tax revenue, the municipality had to wait for the budget from the central government. Decentralization made people feel that the tax they pay is actually used more than centralization. Furthermore, this method can reduce corruption since the tax revenue passes less officers at the central. However, there is an accusation that the potential of officers in each province is not equal. A big and tourist province like Bangkok, Chiangmai or Phuket like to have better local officers and politicians which can efficiently use the tax than others. So, it’s not fair to collect the same tax rate across the country. At this point, I think it’s a chance to make things that had never been possible in Thailand like checking the working of province’ officers, whether it’s transparent and effective or not, becomes possible. Most of Thai people are more likely to focus on the working of the central government than the province and municipal unit. We can use this Act to make people also concerned about it. Therefore, The Chief Executive of the PAO or SAO who cannot work efficiently and transparently will not be re-elected. This will encourage people to have more political awareness since the land for agriculture is also taxed; 31% of Thai people are working in the agricultural sector (NESDC, 2019). Higher political awareness of people, higher the satisfaction of people from the public goods.

Although I agree with the concept of the new Act, in my opinion, the tax collecting should be stronger at some point. Since Thailand still has a high gap of wealth distribution, the tax ceiling on the residential can be higher to reduce the inequality. In addition, since the current property tax still cannot cover all expenditure in each province, in the future, the minimum of property value should be reduced. For example, the first house which values over 30 million should be taxing but still keeps a progressive concept. This will make the municipality collect more tax revenue and less dependence on the central government.

However, the most important thing in Thailand is fairness enforcement, in reality, the top 1%, in Thailand called them “elite”, can lobby and find loopholes to not pay a tax. If the government cannot manage for fairness, only the upper class but not elite have to pay a tax. It could ruin more wealth distribution.

Reference :

Investopedia. (2020). Property tax. Retrieved from https://www.investopedia.com/terms/p/propertytax.asp

Kaewpanya, A. (2019, October 14). The summary of the academic seminar : Land and Building Tax Act 2020. Faculty of Law, Thammasat University. Retrieved from http://www.law.tu.ac.th/summary_seminar_land-and-building-tax/

Mueller, L. (2019, December 17). When Do You Start Paying Property Taxes on a New Home?. Moving. Retrieved from https://www.moving.com/tips/when-do-you-start-paying-property-taxes-on-a-new-home/

Ponchokchai, S. (2014, September 27). Are you ready for the Property tax?. Appraisal and Estate Agents Foundation. Retrieved from

Really great piece of work! Your work could really help many people understand why this Act should be implemented since it not only creates fairness but also contributes to better economic outcomes. I really love how you emphasized on the fact that the upper class and elite are not the same group of people since when we talk about rich people in Thailand, there are tons of them while there are only 1% of the elites (who normally are the one controlling Thai economy). However, for Thailand, a country known for its corrupt officials, I think that other problems (like the justice system and the lobbying of the government) needed to be taken care of before imposing this Act because no matter how good this Act is, many rich would lobby the government or find ways to avoid paying tax anyway. Then, in the end, this Act would be any better than anyone before it.

Thank you for your interest and your reply!!! I agree with you that the real problem of Thailand is corruption especially in the businessman and the politician. However, I think having this Act is also better than the previous act since the previous does not collect any housing tax. I believe that there would be some elites who cannot lobby the government have to pay this tax. We have to outweigh between the cost of the upper class have to bear this burden and how much we can collect from the elite.

Regarding your first point, property tax is housing capitalisation where more tax will be collected. However, more tax revenue means increasing in government intervention. An example of the covid-19 pandemic where Thailand resulted in deepest recession among Asian countries and lots of firms and businesses were shutdown. This showed that government spending cannot help ease the problem of bankruptcy; moreover, soft loans does not go to SMEs, households, or individuals. Well, we can not conclude that big role of government is bad. It depends on the structure of the country and the political system.

Thank you for your interest and reply!!! Yes, i agree with you that the useful of tax also depend on the efficiency of the government. However, since Thailand still a developing country and many people still need government help in actually. I believe that we are not yet ready for private driven economy like Singapore and Malaysia(ASEAN example). So, tax revenue still needed. Furthermore, according to the real tax structure of Thailand, majority of revenue come from VAT(about 42%) which is regressive tax; the poor pay more in terms of percentage of their income. We can collect an income tax in minority. There are many upper class earners that avoid paying income tax and this Act tax the house of upper class to elite. For the problem of inefficient of government, we can vote them out at the next election. If we have good government the problem of using tax will be lessen.

Nice work! The topics are very related to our life and the information is present clearly. I agree with the idea that Thailand needs a new property act and the progressive tax system is very welcome. However, I think this property act might cause problems for low-income people who do not own a house. A higher tax on housing would lead to higher rent for tenants. Since the property tax includes condominiums, which usually is for lower-income people who do not own a house yet, the higher rent can be difficult for them to keep up with.

I do not disagree with the idea behind this property tax. However, this act might lead to some unintended consequences for the most vulnerable group in our society.